Stamp Duty Land Tax is a tax levied in England and Northern Ireland on the purchase of the real estate. Every residential property purchase over £125,000 is subject to SDLT, which is a legal requirement. SDLT calculator will help you figure out how much Stamp Duty you’ll have to pay on your new house, but bear in mind that it’s intended for educational reasons and does not constitute financial advice.

Stamp Duty Land Tax is a tax levied in England and Northern Ireland on the purchase of the real estate. Every residential property purchase over £125,000 is subject to SDLT, which is a legal requirement. SDLT calculator will help you figure out how much Stamp Duty you’ll have to pay on your new house, but bear in mind that it’s intended for educational reasons and does not constitute financial advice.

When does Stamp Duty have to be paid?

If you acquire a property for more than a specific amount, you must pay stamp duty to HMRC within 14 days after completion or face a fine. Your lawyer or solicitor should handle this for you and make sure you don’t miss the deadline. Some buyers want to finance the Stamp Duty tax as part of their mortgage. In December 2014, major modifications to stamp duty were enacted. The old stamp duty system was seen as a slab tax, with rates increasing at each SDLT threshold and being applied to the entire property purchase price.

Is it possible to minimize Stamp Duty?

Non-removable fixtures and fittings such as freestanding closets, sofas, refrigerators, carpets, and curtains are exempt from Stamp Duty and can thus be removed from the final property price because it is only imposed on land acquisitions. All of it connected to a property, including light switches, is deemed part of it and subject to SDLT.

The significance of making use of a stamp duty calculator

Despite the fact that SDLT appears to be quite simple to calculate, it is believed that one out of every five homeowners has overpaid on their SDLT return at some point. This is due to the fact that stamp duty laws are always changing. In fact, more modifications to SDLT laws have occurred in recent years than any other type of tax. This is why, when buying a home, you should always consult with an SDLT expert. They’ll utilize the most up-to-date stamp duty calculator and have the knowledge to keep up with the current SDLT rates.

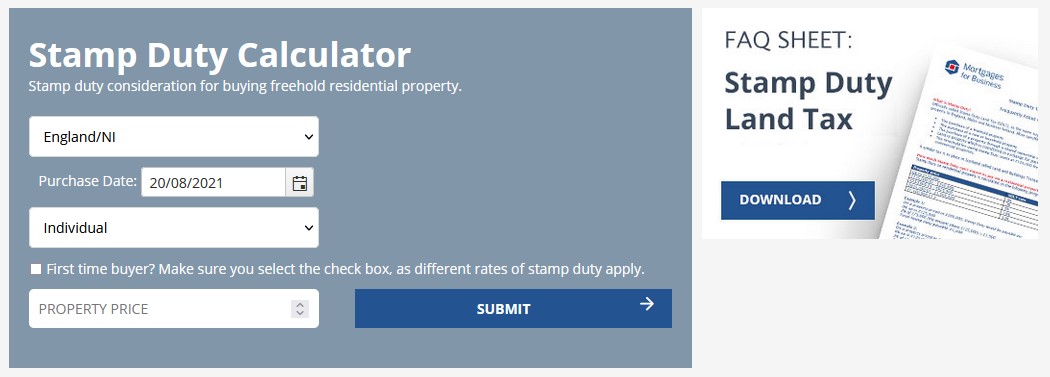

How do I figure out how much stamp duty I owe using the SDLT calculator?

- From the drop-down choices, choose First-Time Buyer, Moving Home, or Additional Property.

- Fill in the cost of the purchase.

- Click the Calculate button to quickly calculate stamp duty.

Payment is contingent on the outcome of the next events.

A transaction could include a sum that the buyer will only pay if a specific event occurs in the future. The contingent consideration is what it’s called. In these situations, SDLT is paid on the presumption that the contingency will occur. Although the buyer can ask to have SDLT on the contingent amount deferred, HMRC will still impose the tax at the relevant rate on the total chargeable consideration.

Conclusion

while applying for a home loan On top of the housing price, there is a slew of other costs to consider. Stamp duty and registration fees are two additional fees that must be paid when registering ownership of a new home. Stamp duty calculators are designed to help you figure out how much stamp duty you’ll have to pay on your home so you can figure out how much home loan you’ll need.